How To Calculate Sales Tax On A Used Car In California

For example if the total of state county and local taxes was 8 percent and the total taxable cost. The sales tax is higher in many areas due to district taxes.

Free Online 2019 Us Sales Tax Calculator For Michigan Fast And Easy 2019 Sales Tax Tool For Businesses And People From Michigan United Sales Tax Tax Michigan

Free Online 2019 Us Sales Tax Calculator For Michigan Fast And Easy 2019 Sales Tax Tool For Businesses And People From Michigan United Sales Tax Tax Michigan

California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments.

How to calculate sales tax on a used car in california. Find out what the state local and county sales tax rates are for your area see Resources. The link below lists all of the fees necessary to buy a car new and used. The site will then tell you what taxes you will have to pay.

Add up all the figures you have from taxes and registration. Calculating Sales Tax Summary. The state tax rate the local tax rate and any district tax rate that may be in effect.

For example if the current tax rate in effect is 9 percent the tax rate for a qualifying purchase would be 400 percent. There is also a 50 dollar emissions testing fee which is applicable to the sale of a vehicle. Some areas have more than one district tax pushing sales taxes up even more.

For example if you are buying a new car for 25000 and the dealer is giving you 10000 for your trade you. 4010 Calculating Use Tax Amount. How Much Is Tax And Registration On A Used Car In California.

You will enter the date and type of car you purchased followed by the purchase price the city county and zip code where you live. Of this 125 percent goes to. Once you calculate your auto sales tax youll have a fuller understanding of the complete costs associated with your car purchase.

View the California state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator. Youll pay 925 percent sales tax if you buy an item in this city because you add the state rate of 725 percent to the county rate of 2 percent. This rate is standard across California and is the lowest sales tax rate a seller or consumer can pay.

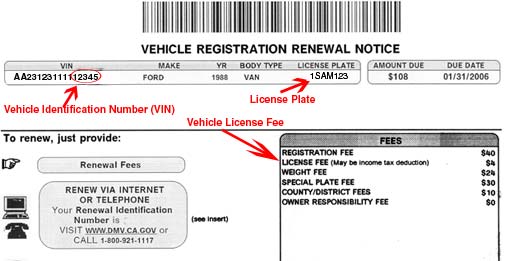

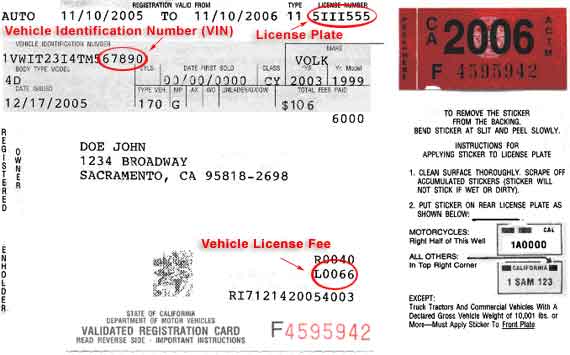

Tax Season Vehicle License Fee VLF paid for tax purposes Select a Calculator to Begin Registration renewal fees Registration fees for new vehicles that will be purchased in California from a licensed California dealer Registration fees for nonresident vehicles registered outside the state of California Registration fees for used vehicles that will be purchased in California Disregard. Car registration is 60. DMV fees are about 564 on a 39750 vehicle based on a percentage of the vehicles value.

Multiply the net price of your vehicle by the sales tax percentage. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments. Sales tax is 725.

California Used Car Sales Tax Fees. California Sales Tax on Car Purchases According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. Find your state below to determine the total cost of your new car including the.

The new car cost and trade value will come off the sales contract for the car deal. Step 5 Multiply the sales tax rate by your taxable purchase price. Local governments such as districts and cities can collect additional taxes on the sale of vehicles up to 25 in addition to the state tax.

Cost Breakdown In our calculation the taxable amount is 39835 which equals the sale price of 39750 plus the doc fee of 85. Each application subject to use tax must show the purchase price on the back of the Certificate of Title or include a bill of sale. May 15 2019 admen Interesting.

The starting point for calculating sales tax is the statewide rate of 75 percent. The sales and use tax rate in a specific California location has three parts. Remember to convert the sales tax percentage to decimal format.

California statewide sales tax on new used vehicles is 725. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. If you travel to San Francisco County youll pay a.

Applications subject to use tax received in the mail without a purchase price must be returned to the applicant for. With the true price tag. Local governments such as districts and cities can collect additional taxes on the sale of vehicles up to 25 in addition to the state tax.

State sales and use taxes provide revenue to the states General Fund to cities and counties through specific state fund allocations and to. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. To calculate the tax rate for a qualifying purchase subtract 500 percent from the tax rate that would normally apply at the location where the vehicle is registered.

For example if your state sales tax rate is 4 you would multiply your net purchase price by 004. California has a 6 statewide sales tax rate but also has 511 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2445 on top of the state tax. A CDTFA 1138 is required for commercial vehicles as specified under the Use Fuel Tax Law showing the amount of use tax due.

California Used Car Sales Tax Fees 2020 Everquote

California Used Car Sales Tax Fees 2020 Everquote

Calculateme Com Calculate Just About Everything Area Of A Circle Calculator Gas Mileage

Calculateme Com Calculate Just About Everything Area Of A Circle Calculator Gas Mileage

California Vehicle Tax Everything You Need To Know

California Vehicle Tax Everything You Need To Know

Vehicle Registration Licensing Fee Calculators California Dmv

Vehicle Registration Licensing Fee Calculators California Dmv

How To Use A California Car Sales Tax Calculator

How To Use A California Car Sales Tax Calculator

Vehicle Registration Licensing Fee Calculators California Dmv

Vehicle Registration Licensing Fee Calculators California Dmv

A Primer On The Vehicle License Fee

A Primer On The Vehicle License Fee

Taxjar Woocommerce Woocommerce Website Design Sales Tax

Taxjar Woocommerce Woocommerce Website Design Sales Tax

New 2021 Toyota Rav4 Hybrid Xse For Sale In Sunnyvale Ca Toyota Sunnyvale Toyota Rav4 Hybrid Rav4 Hybrid Toyota Rav4

New 2021 Toyota Rav4 Hybrid Xse For Sale In Sunnyvale Ca Toyota Sunnyvale Toyota Rav4 Hybrid Rav4 Hybrid Toyota Rav4

Get Details Of Authorized Mercedes Benz Car Dealers Showrooms In Temecula Ca Call Us For Sales At 951 225 1145 Mercedes Benz Mercedes Benz Cars Mercedes

Get Details Of Authorized Mercedes Benz Car Dealers Showrooms In Temecula Ca Call Us For Sales At 951 225 1145 Mercedes Benz Mercedes Benz Cars Mercedes

How Do I Calculate Income Tax On Salary With Example Life Insurance Premium Life Insurance Calculator Income Tax

How Do I Calculate Income Tax On Salary With Example Life Insurance Premium Life Insurance Calculator Income Tax

Sanjaytaxpro Provides Business And Personal Tax Preparation Services In San Jose Sunnyvale And Other Maj Business Tax Tax Preparation Tax Preparation Services

Sanjaytaxpro Provides Business And Personal Tax Preparation Services In San Jose Sunnyvale And Other Maj Business Tax Tax Preparation Tax Preparation Services

90s Formula Ad 2 Pontiac Firebird Pontiac Chevy Muscle Cars

90s Formula Ad 2 Pontiac Firebird Pontiac Chevy Muscle Cars

Vehicle Registration Licensing Fee Calculators California Dmv

Vehicle Registration Licensing Fee Calculators California Dmv

4 Part Auto Repair Order Forms With Carbon Valid In California Auto Repair Automotive Repair Auto Repair Estimates

4 Part Auto Repair Order Forms With Carbon Valid In California Auto Repair Automotive Repair Auto Repair Estimates

Post a Comment for "How To Calculate Sales Tax On A Used Car In California"